Flights to Iceland

Search flights on Iceland's biggest travel marketplace.

Find the perfect flight

Select flights

Round trip

Economy

Select travel dates

DepartureReturn

Add travelers

1 traveler

Add travelers

1 traveler

Flights to popular cities in Iceland

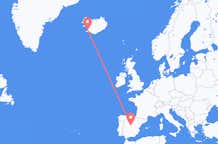

Flights to Iceland from other countries in Europe

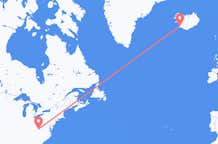

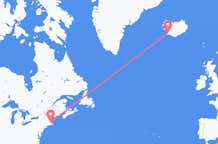

Flights to Iceland from popular cities worldwide

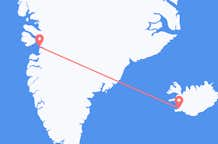

Domestic flights in Iceland

Frequently asked questions

How do I find the best deals on flights to Iceland?

To find the best deals on flights to Iceland, consider flexible travel dates, traveling during off-peak seasons, comparing prices of several airlines, checking out alternative airports, and booking in advance.

To explore your best options, check out the flight search function on Guide to Iceland. The best travel hack for booking cheap flights to Iceland is to fly on weekdays instead of weekends. In combination with an early reservation, travelers can secure the best deals to Iceland.

By following these tips, you can increase your chances of finding the best deals on flights to Iceland. Remember to stay flexible with your travel dates, consider nearby airports, and book your flight at the optimal time to maximize your savings.

Get the best deals by booking your flights with Guide to Iceland.

To explore your best options, check out the flight search function on Guide to Iceland. The best travel hack for booking cheap flights to Iceland is to fly on weekdays instead of weekends. In combination with an early reservation, travelers can secure the best deals to Iceland.

By following these tips, you can increase your chances of finding the best deals on flights to Iceland. Remember to stay flexible with your travel dates, consider nearby airports, and book your flight at the optimal time to maximize your savings.

Get the best deals by booking your flights with Guide to Iceland.

How far in advance should I book my flight to Iceland for the best prices?

It’s recommended to book 2 to 3 months in advance to get the best prices on flights to Iceland. If you plan to fly to Iceland in the busiest travel season, you may want to book your flight even earlier. To secure the best deal, use a booking platform like Guide to Iceland to compare all available flights to Iceland.

What are the most popular airlines that operate flights to Iceland?

Travelers can choose from several airlines that operate flights to Iceland. Some of the best-known airlines with scheduled flights to Iceland are Finnair, Transavia, Wizz Air, Neos Air, Transavia France, Wizz Air Malta, Iberia Express. You can find out what airlines offer flights to Iceland from your city and country of departure by entering your travel details in the search function on this page.

Discover and compare all airlines with flights to Iceland with Guide to Iceland.

Discover and compare all airlines with flights to Iceland with Guide to Iceland.

What cities offer direct flights to Iceland?

Some of the most popular cities of departure that offer direct flights to Iceland are Venice, Verona, Milan, Rome, Bologna, Athens, Málaga, Madrid, Alicante, Barcelona, Tenerife, Palma, Las Palmas, Stockholm, Gothenburg, Porto, Lisbon, Amsterdam, Vilnius, Budapest, Nice, Paris, Sørvágur, Gdansk, Katowice, Warsaw, Oslo, Bergen, Split, Birmingham, Newcastle upon Tyne, Edinburgh, London, Glasgow, Manchester, Leeds, Helsinki, Prague, Geneva, Zurich, Brussels, Stuttgart, Düsseldorf, Hamburg, Berlin, Billund, Copenhagen, Vancouver, Montreal, Hamilton, Calgary, Toronto, Halifax, Vienna, Dublin, Nuuk, Ilulissat, Kulusuk, Narsarsuaq, Boston, Minneapolis, Detroit, Chicago, Orlando, Raleigh, Pittsburgh, Washington, D. C. , New York, Portland, Denver, Seattle, Riga. Prices for direct flights to Iceland start from around 36 EUR.

Find and compare flights to Iceland from popular destinations all over the world with Guide to Iceland. Enter your travel details in the search tool at the top of this page and press “search” to view your options.

Find and compare flights to Iceland from popular destinations all over the world with Guide to Iceland. Enter your travel details in the search tool at the top of this page and press “search” to view your options.

How do I find the cheapest round-trip flights to Iceland?

The cheapest direct round-trip flight to Iceland costs around 69 EUR. To find the most economical round-trip flight from your preferred departure city to Iceland, you can use the search bar at the top of this page. Consider flexible dates and explore several airlines to find the best deals. It's advisable to book your flights in advance to secure the best deal as prices may vary depending on the departure airport and the time of booking.

This particular round-trip flight provides a great opportunity for travelers who wish to access Iceland at a cheaper price.

Keep in mind that prices for round-trip flights can vary depending on the specific departure and return dates, as well as the departure airport. To find the best deals, it's recommended to use the search bar and compare prices from different airlines. Guide to Iceland can assist you in finding and comparing all available round-trip flights to Iceland.

Book these flights or find other cheap round-trip flight options by using the search bar.

This particular round-trip flight provides a great opportunity for travelers who wish to access Iceland at a cheaper price.

Keep in mind that prices for round-trip flights can vary depending on the specific departure and return dates, as well as the departure airport. To find the best deals, it's recommended to use the search bar and compare prices from different airlines. Guide to Iceland can assist you in finding and comparing all available round-trip flights to Iceland.

Book these flights or find other cheap round-trip flight options by using the search bar.

How do I find the cheapest one-way flight to Iceland?

The cheapest direct one-way flight to Iceland costs around 36 EUR and is offered by the airline easyJet. You can find the cheapest one-way flight from your preferred departure city to Iceland by using the search function at the top of this page. With flexible dates and exploring several airlines, you’re more likely to find the best deals to Iceland. Guide to Iceland makes it easy for you to find and compare all available flights departing to Iceland.

Keep in mind that prices may vary depending on the departure airport and the time of booking. It's advisable to book your flight in advance to secure the best deal.

For example, if you’re interested in traveling from Edinburgh Airport on April 22, you can take advantage of a low-cost option arriving at Keflavík International Airport in Iceland at 08:55 local time. This flight provides travelers a great opportunity to access Iceland without breaking the bank.

Compare flights and book your trip to Iceland with Guide to Iceland by using the search bar at the top of this page.

Keep in mind that prices may vary depending on the departure airport and the time of booking. It's advisable to book your flight in advance to secure the best deal.

For example, if you’re interested in traveling from Edinburgh Airport on April 22, you can take advantage of a low-cost option arriving at Keflavík International Airport in Iceland at 08:55 local time. This flight provides travelers a great opportunity to access Iceland without breaking the bank.

Compare flights and book your trip to Iceland with Guide to Iceland by using the search bar at the top of this page.

What airline offers the cheapest flights to Iceland?

The airline with the cheapest flights to Iceland is easyJet. You can explore more airline options for your journey to Iceland by using the search bar at the top of this page. With just a simple sort, you can conveniently arrange your findings from the cheapest to the premium options.

Find flights with easyJet and other cheap airlines with Guide to Iceland.

Find flights with easyJet and other cheap airlines with Guide to Iceland.

Which is the cheapest day of the week to fly to Iceland?

The cheapest day of the week for flights to Iceland is typically Tuesday. The cheapest day to fly to Iceland may however vary depending on where in the world you are departing from. The easiest way to find the most affordable flights to Iceland is by entering your travel details in the search function and sorting the results by price to compare all your best options.

When is the cheapest month for flights to Iceland?

April is the cheapest month for round-trip flights to Iceland. The cheapest flights in April are around 69 EUR. Please note that the cheapest month to fly to Iceland may depend on your country of departure and what airlines operate flights from your city.

Find more cheap flights in the month of April by using the search bar at the top of the page.

Find more cheap flights in the month of April by using the search bar at the top of the page.

What is the best airline with flights to Iceland?

The best-rated airline with flights to Iceland is Sky High Aviation Services, with 13 passengers having rated it an average of 5.0 out of 5 stars.

The cheapest flight scheduled to Iceland with Sky High Aviation Services departs from Valencia on May 9. The return flight to Valencia leaves from Iceland on January 1. The flights operate between Arturo Michelena International Airport and Keflavík International Airport.

Find more flights to Iceland with Sky High Aviation Services and other top-rated airlines by searching with Guide to Iceland.

The cheapest flight scheduled to Iceland with Sky High Aviation Services departs from Valencia on May 9. The return flight to Valencia leaves from Iceland on January 1. The flights operate between Arturo Michelena International Airport and Keflavík International Airport.

Find more flights to Iceland with Sky High Aviation Services and other top-rated airlines by searching with Guide to Iceland.

How do I find the best round-trip flights to Iceland?

If you’re searching for the best round-trip flights to Iceland, you’re looking for convenient, comfortable, non-stop flights at a reasonable price. To find the best direct flights to Iceland from your country and city of departure, we recommend booking your flights 2 to 6 months in advance and using a travel comparison platform like Guide to Iceland. By entering your travel details in the search bar on this page, you can access all available flights to Iceland on your preferred travel dates. We recommend using the filters on the left-hand side of your screen to narrow down your options. You can also sort the results based on duration, price, and most recommendations.

If you’re interested in traveling from the United Kingdom to Iceland, you can catch a popular flight departing from Edinburgh to Reykjavík on April 22. The return flight for this journey is scheduled on May 13. This best-rated round-trip flight to Iceland is offered by easyJet and start from 69 EUR. The departure airport is Edinburgh Airport and the arrival airport is Keflavík International Airport.

Find more top-rated round-trip flights to Iceland by checking out Guide to Iceland.

If you’re interested in traveling from the United Kingdom to Iceland, you can catch a popular flight departing from Edinburgh to Reykjavík on April 22. The return flight for this journey is scheduled on May 13. This best-rated round-trip flight to Iceland is offered by easyJet and start from 69 EUR. The departure airport is Edinburgh Airport and the arrival airport is Keflavík International Airport.

Find more top-rated round-trip flights to Iceland by checking out Guide to Iceland.

How do I find the best one-way flights to Iceland?

The easiest way to find the best one-way flights to Iceland is to start the search early, keep your travel dates flexible, and use a travel comparison platform to review all available options. Whether you define the best flights as the cheapest, most convenient, or most comfortable, the best way to start is to enter your travel details in the search bar on this page and click search. Continue by sorting the search results based on duration, price, or most recommendations and using the filters on the left-hand side of your screen to narrow down your options. If you can’t find a suitable flight, consider an alternative airport or try adjusting your travel dates.

An example of a popular option is this best-rated one-way flight to Iceland offered by easyJet. The currently cheapest scheduled departure is on April 22 from Edinburgh Airport, arriving at Keflavík International Airport 3 hours later. The price for this one-way flight to Iceland starts from 36 EUR.

Find more of the best-rated one-way flights to Iceland with the help of Guide to Iceland.

An example of a popular option is this best-rated one-way flight to Iceland offered by easyJet. The currently cheapest scheduled departure is on April 22 from Edinburgh Airport, arriving at Keflavík International Airport 3 hours later. The price for this one-way flight to Iceland starts from 36 EUR.

Find more of the best-rated one-way flights to Iceland with the help of Guide to Iceland.

What is the shortest flight to Iceland?

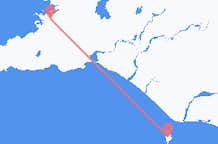

The shortest flight to Iceland takes approximately 2 hours. This flight operates between Vágar Airport in in Sørvágur, Faroe Islands, and Keflavík International Airport in Reykjavík, Iceland. This flight route is offered by the airline Atlantic Airways and the price of a ticket starts from 140 EUR.

Book flights from destinations all over the world to Iceland with Guide to Iceland.

Book flights from destinations all over the world to Iceland with Guide to Iceland.

How much is the average cost of round-trip flights to Iceland?

Round-trip flights to Iceland typically cost an average of 379 EUR.

To find the exact price of a specific round-trip route, fill out your preferred city of departure and travel dates in the search bar. Press search to view and compare prices for all available round-trip flights to Iceland.

To find the exact price of a specific round-trip route, fill out your preferred city of departure and travel dates in the search bar. Press search to view and compare prices for all available round-trip flights to Iceland.

How much is the average cost of a one-way flight to Iceland?

A one-way flight to Iceland typically costs an average of 284 EUR.

To find the exact price of a specific one-way trip, add your preferred city of departure and travel dates in the search tool. Click search to view and compare prices for all available one-way flights to Iceland.

To find the exact price of a specific one-way trip, add your preferred city of departure and travel dates in the search tool. Click search to view and compare prices for all available one-way flights to Iceland.

How much is the average cost of a direct flight to Iceland?

A non-stop flight to Iceland typically costs around 379 EUR.

Add your travel details into the search bar at the top of this page and click search to view and compare all available direct flights to Iceland.

Add your travel details into the search bar at the top of this page and click search to view and compare all available direct flights to Iceland.

Can I make changes or cancel my flight booking to Iceland?

Yes, you can generally make changes or cancel your flight booking to Iceland. The costs associated with rescheduling or canceling a flight to Iceland however depend on the specific airline's policies and the type of ticket you purchased.

Each airline has its own rules and policies regarding changes and cancellations, so it's important to review the terms and conditions upon making your Iceland flight booking. Ticket types also play a role, with refundable tickets offering more flexibility and non-refundable tickets often coming with restrictions and fees.

Most flight tickets to Iceland come with specific timeframes for changes and cancellations without additional fees. Outside these timeframes or with non-refundable tickets, fees or penalties may apply.

You can always contact our travel agents at Guide to Iceland to get more detailed information or assistance with rebooking or canceling your flights. Just click the chat icon in the bottom right-hand corner of your screen or send an email to info@guidetoiceland. Is to get started.

Each airline has its own rules and policies regarding changes and cancellations, so it's important to review the terms and conditions upon making your Iceland flight booking. Ticket types also play a role, with refundable tickets offering more flexibility and non-refundable tickets often coming with restrictions and fees.

Most flight tickets to Iceland come with specific timeframes for changes and cancellations without additional fees. Outside these timeframes or with non-refundable tickets, fees or penalties may apply.

You can always contact our travel agents at Guide to Iceland to get more detailed information or assistance with rebooking or canceling your flights. Just click the chat icon in the bottom right-hand corner of your screen or send an email to info@guidetoiceland. Is to get started.

Install Iceland’s biggest travel app

Download Iceland’s biggest travel marketplace to your phone to manage your entire trip in one place

Scan this QR code with your phone camera and press the link that appears to add Iceland’s biggest travel marketplace into your pocket. Enter your phone number or email address to receive an SMS or email with the download link.